b&o tax credit

Please call the SMSA office at 253 891-4260 or email us. You can make the donation by sending a check to the following address.

B Amp O Tax Return City Of Bellevue

Because Buckley Downtown Association is a 501 c 3 non-profit organizations other tax incentives may apply.

. This article authored by Scott Schiefelbein and Robert Wood 2 provides helpful tips regarding some of the nexus traps the BO tax poses for the unwary company seeking to do business in Washington and was originally published in the spring issue of the Oregon State Bar Taxation Section Newsletter. B O Tax. This means there are no deductions from the BO tax for labor.

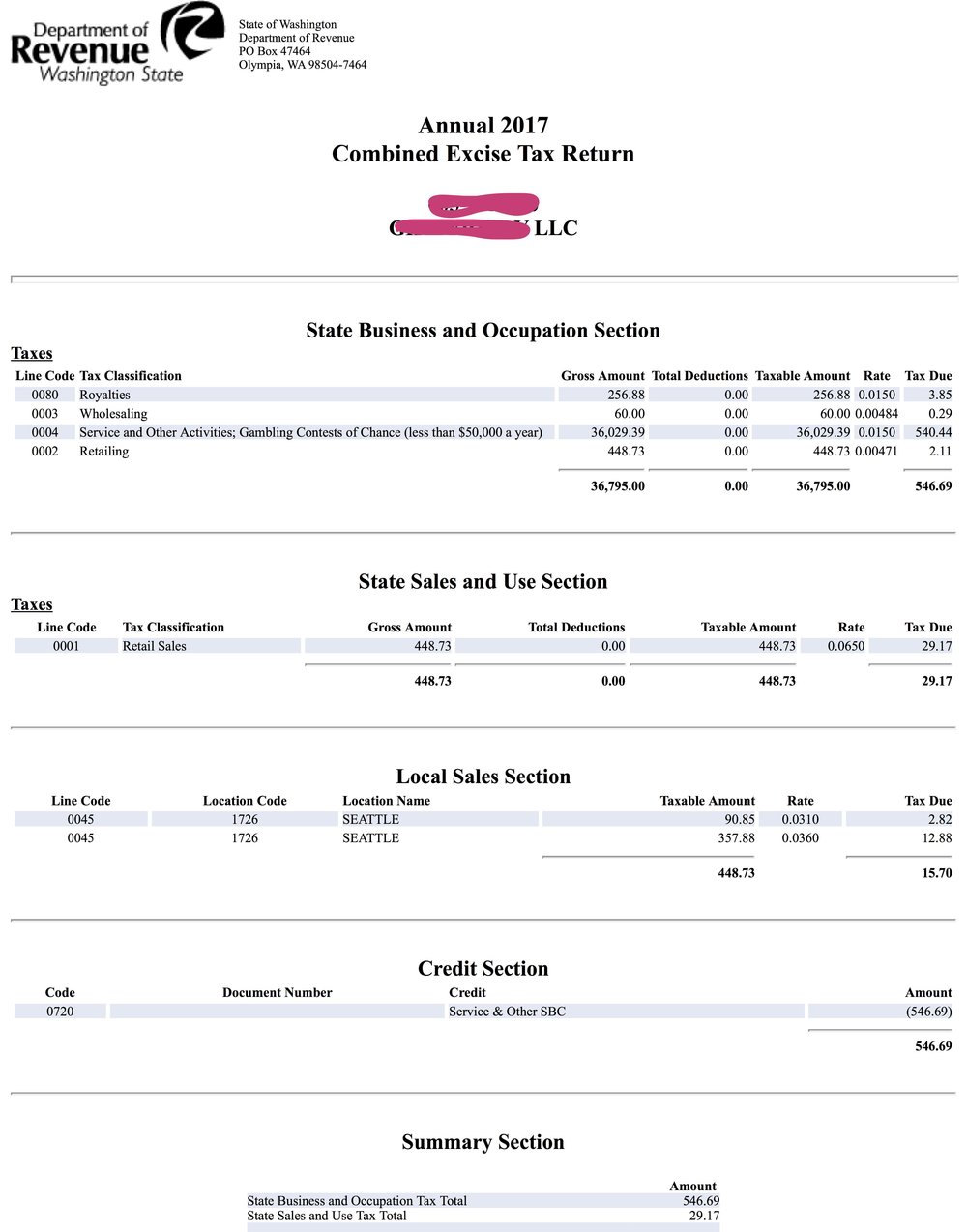

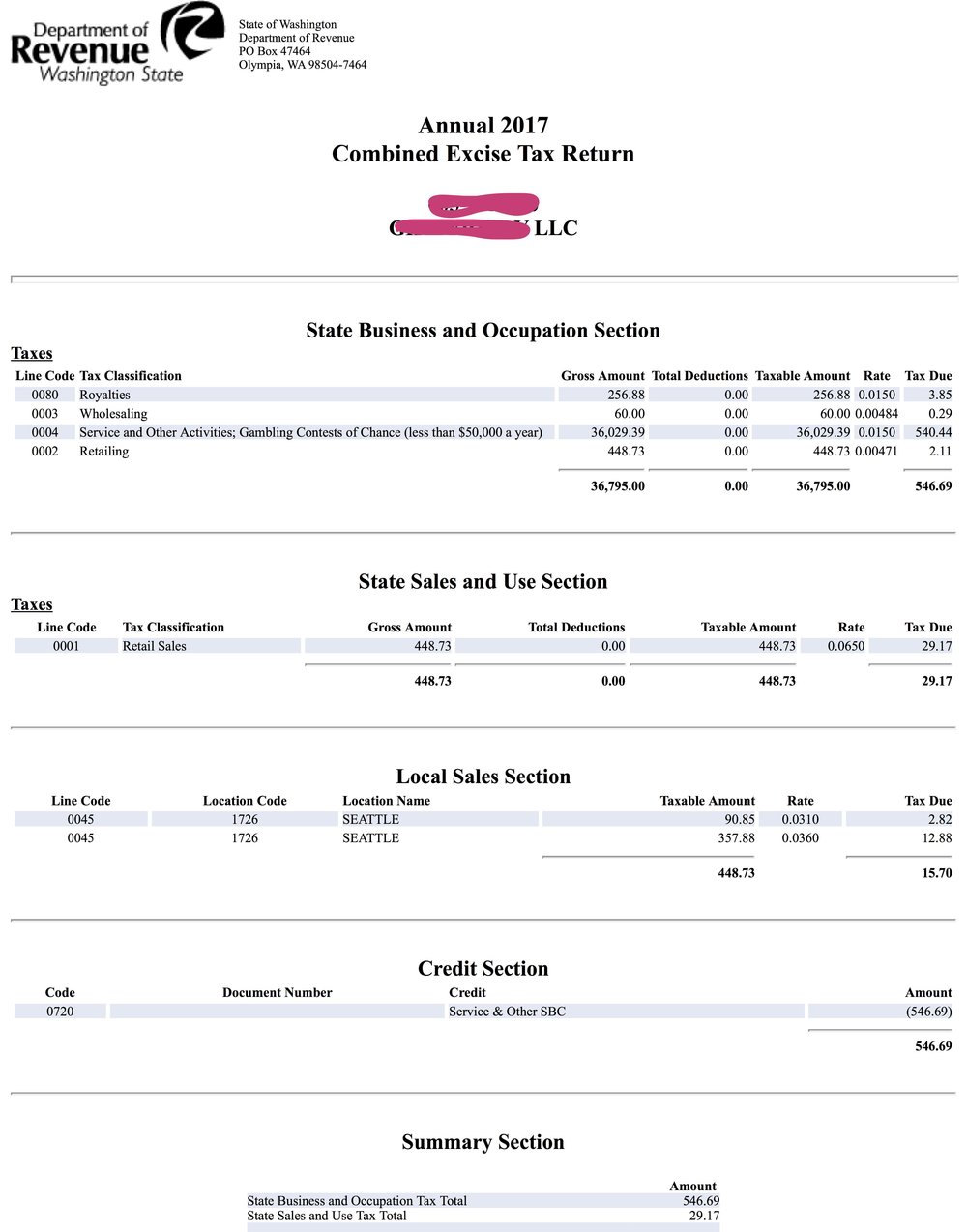

Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax. Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO tax or public utility tax PUT. It is a type of gross receipts tax because it is levied on gross income rather than net income.

This credit is commonly referred to as the small business BO tax credit or small business credit SBC. Small business tax relief based on income of business. It is measured on the value of products gross proceeds of sales or gross income of the business.

Washington unlike many other states does not have an income tax. Donate 1000 and receive a credit of 750 applied to your 2023 BO tax obligation. In January 2023 when you go to pay your BO online you will have the credit available in your account.

Because Sumner Main Street Association is a 501 c 3 non-profit organizations other tax incentives may apply. I would also like to thank Sen. Mail your check to.

The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility Tax PUT credit for private contributions given to eligible downtown organizations. New BO Tax Credit. The credit is taken against the BO tax for each new employment position filled and maintained by qualified businesses located in eligible areas.

A new application must be submitted to the. The state BO tax is a gross receipts tax. While deductions are not permitted for labor materials or other overhead expenses the State of Washi.

If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s. This means there are no deductions from the BO tax for labor. The MATC is also known as Schedule.

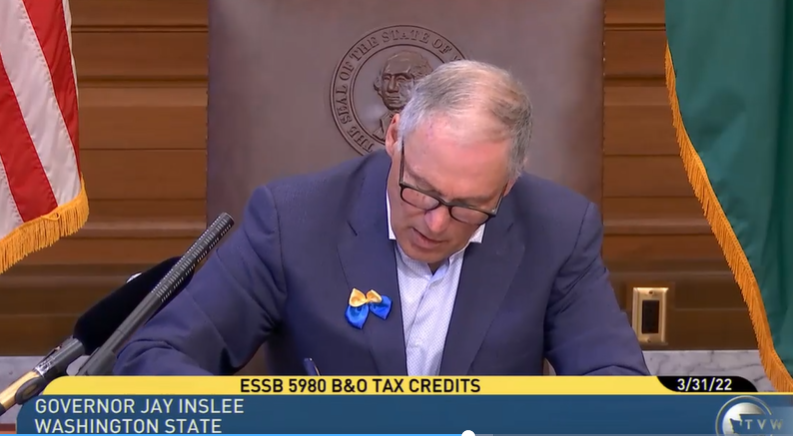

Small Business Thanks Governor For Signing B O Tax Credit Bill Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown. It is measured on the value of products gross proceeds of sale or gross income of the business. As a larger number of taxpayers doing business in Washington will be required.

Business and occupation tax overview. High Technology B. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization.

Small Business BO Tax Credit. This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. If you make 122000 or.

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown. Full-Time Employees For a full-time employment position to be eligible for credit it must be requested by application before the new position is filled. States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky.

For small a Washington corporation or LLC it. Its really that simple. Washingtons BO is an excise tax.

However your business may qualify for certain exemptions deductions or credits. Washington unlike many other states does not have an income tax. The major classifications and tax rates are.

The amount of small business BO tax credit available. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. As your income goes up you get a smaller and smaller credit until you make enough to pay the full percentage.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Check with your accountant for more information. By exempting firms with up to 125000 in gross receipts from the Business Occupations Tax BO and expanding the Small Business Tax Credit to those enterprises earning nearly 250000 annually Senate Bill 5980 will provide welcome relief for some 276000 small businesses.

So for example if you pay ServiceOther B O annually and your annual business income is 56000 this gross income is tax-free. A pledge of 1000 equals a tax credit of 750 that will be applied to your 2023 B O tax obligation. Service and Other Activities.

Puyallup Main Street Association. In 2020 when you go to pay your BO online you will be given the amount of your credit in a drop-down menu and asked how much you would like to apply. The Downtown Waterfront Alliance PO.

Make your payment to The Alliance by Tuesday November 15 2022. Box 771 Gig Harbor WA 98335. Beginning January 1 2020 financial institutions that are members of a consolidated financial institution group reporting annual net income of at least 1 billion for the previous calendar year are subject to an additional tax of 12.

Small Business B. Multiple Activities Tax Credit MATC Small Business BO Tax Credit. The City Business Occupation BO tax is a gross receipts tax.

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. Both Washington and Tacomas BO tax are calculated on the gross income from activities. Washington State is considered one of the better tax states in no small part because of its Small Business BO Tax Credit.

However you may be entitled to the Multiple Activities Tax Credit MATC. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. The BO tax for labor materials taxes or other costs of doing business.

Additionally a portion of your tax. Rural County B. Illinois newly signed 465 billion budget which includes 18 billion in election-year tax relief and put a 1 billion deposit into the states.

Its really that simple. For example if you extract or manufacture goods for your own use you owe BO tax. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations.

Box 771 Gig Harbor WA 98335. Washingtons BO tax is calculated on the gross income from activities. Up to 75 of your contribution to SDA in 2012 may be used against your 2013 BO or PUT tax liability.

The credit equals 20 percent of the wages and benefits a business pays to or on behalf of a qualified employee up to a maximum of 1500 for each. Reuven Carlyle for his leadership. Check with your accountant for further details.

Projects Programs Kent Downtown Partnership

B O Tax Credit Incentive Program Downtown Camas Shops Restaurants Events In Camas Wa

B Amp O Tax Guide City Of Bellevue

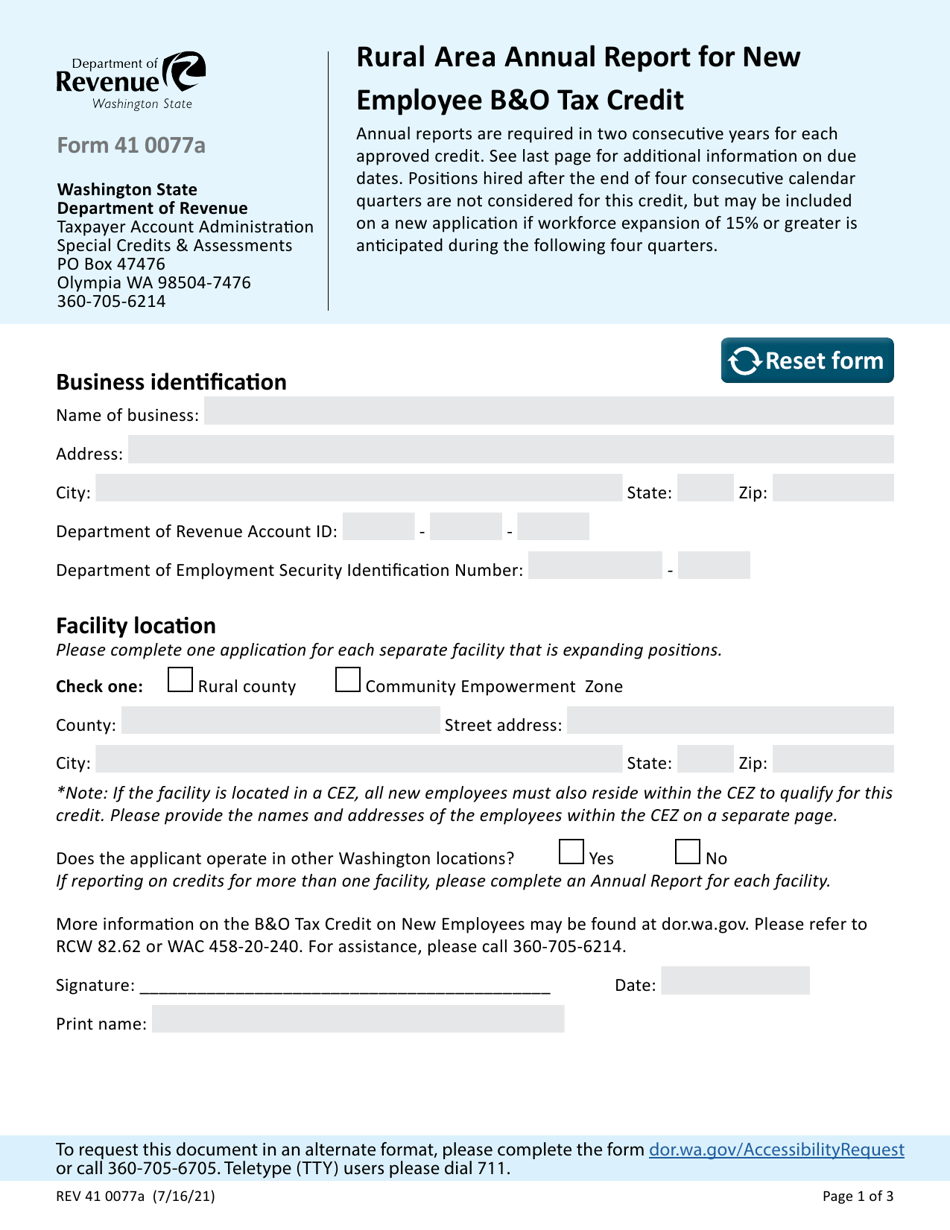

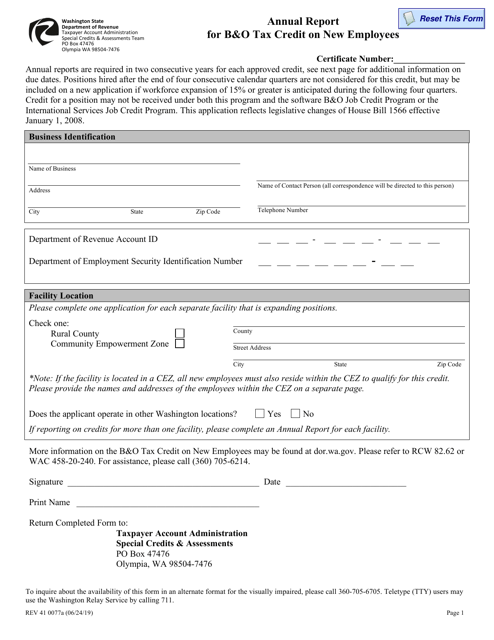

Form Rev41 0077a Download Fillable Pdf Or Fill Online Rural Area Annual Report For New Employee B O Tax Credit Washington Templateroller

Small Business Thanks Governor For Signing B O Tax Credit Bill

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

B O Tax Credit Program Sumner Main Street Association

B O Tax Credit Program Puyallup Main Street Association

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Form Rev41 0077a Download Fillable Pdf Or Fill Online Annual Report For B O Tax Credit On New Employees Washington Templateroller